February 6, 2026

MCP: The Open Protocol Supercharging AI for FinOps Automation

10 min read

As cloud environments expand and AI becomes part of everyday operations, managing technology spend has quietly become one of the toughest leadership challenges for modern organizations. What was once a simple infrastructure decision is now a constantly shifting mix of cloud services, data platforms, AI models, and distributed systems – all generating costs in different ways.

FinOps teams are now expected to keep track of multi-cloud usage, control AI-related spending, forecast budgets, improve unit economics, and connect infrastructure costs to real business results – often under tight timelines. Yet in many companies, this work is still held together by spreadsheets, disconnected dashboards, and after-the-fact reports. By the time insights arrive, the opportunity to act has usually passed.

At the same time, AI agents are rapidly evolving from simple chat interfaces into autonomous systems capable of reasoning, planning, and executing complex workflows. For FinOps, this creates a powerful opportunity: moving from reactive cost management to intelligent, automated financial governance.

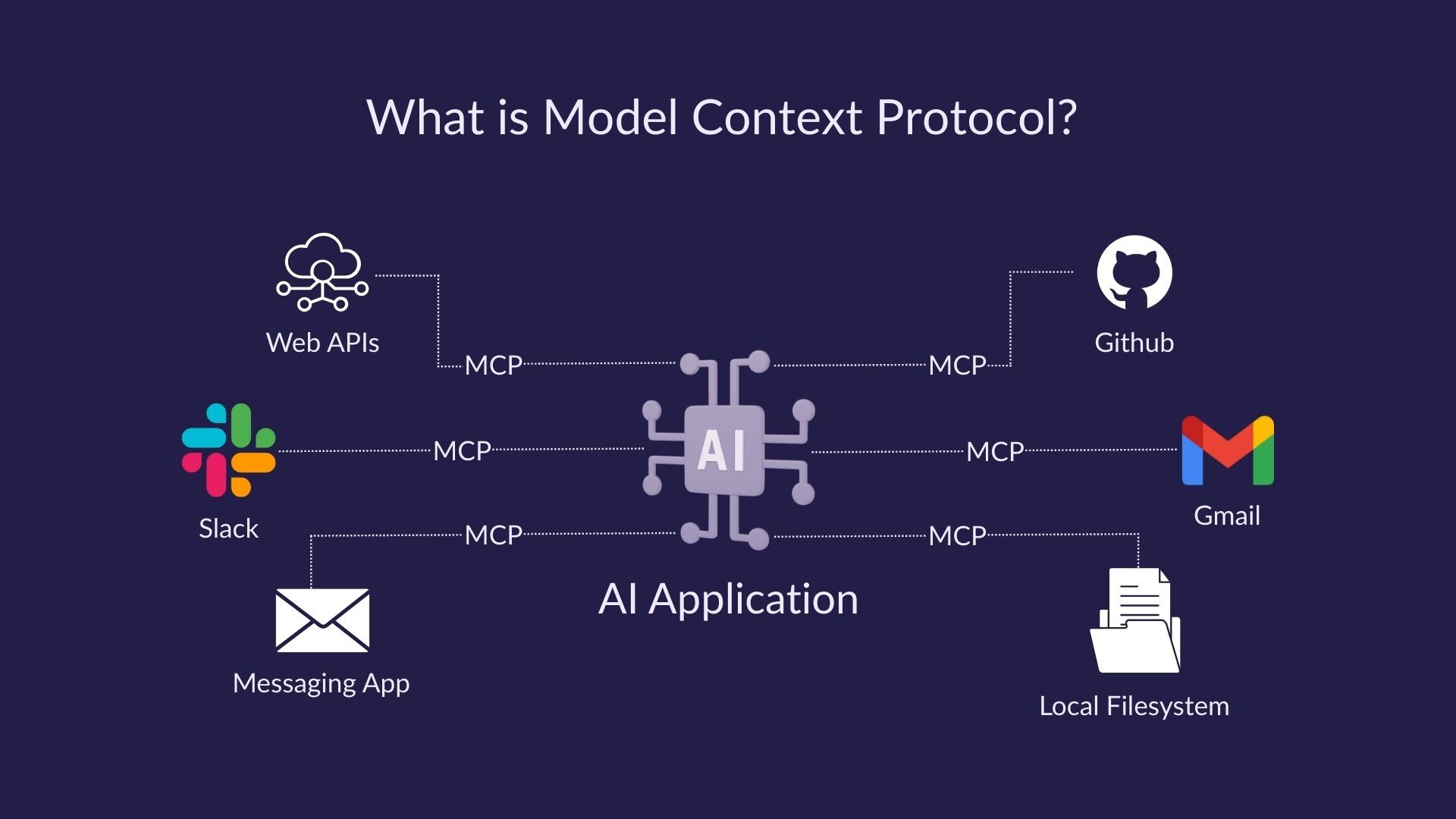

At the center of this shift is MCP, the Model Context Protocol, an open standard designed to help AI systems access, understand, and act on enterprise data securely and consistently.

In this blog, we explore how MCP is transforming FinOps automation in 2026, why open protocols matter, and how organizations can use this foundation to build truly intelligent cost governance.

Why FinOps Needs Open AI Infrastructure

Modern cloud environments are no longer centralized or predictable. They are distributed across regions, providers, platforms, and services. AI workloads run alongside traditional applications. Data flows continuously between systems. Pricing models change frequently. Usage patterns shift by the hour.

In this environment, traditional FinOps approaches struggle to scale.

Most teams still depend on:

Static dashboards

Periodic reports

Manual reviews

Rule-based automation

Spreadsheet-driven forecasting

These methods were designed for simpler infrastructure. They are not built for AI-driven, multi-cloud, real-time environments.

Meanwhile, organizations are experimenting with AI copilots and agents to analyze costs, generate insights, and recommend actions. But these systems often operate with limited context. They lack consistent access to billing data, usage metrics, contracts, policies, and business priorities.

Without shared context, AI cannot make reliable financial decisions.

This is the gap MCP is designed to fill.

What Is MCP (Model Context Protocol)?

MCP, or Model Context Protocol, is an open standard that defines how AI systems securely access external tools, databases, and enterprise systems.

Instead of building custom integrations for every platform, MCP provides a standardized way for AI agents to retrieve structured, permissioned context from multiple sources.

In simple terms, MCP allows AI systems to understand:

What data exists

Where it lives

How to access it

What they are allowed to do with it

Unlike traditional APIs, which are often built for specific applications, MCP is designed for reasoning systems. It focuses on delivering complete, relevant context so AI can make informed decisions.

For FinOps, this means AI agents can access:

Cloud billing records

Usage metrics

Tagging structures

Budget policies

Forecast models

Contract terms

Sustainability data

Business KPIs

All through a consistent interface. This transforms AI from a reporting tool into a decision engine.

The Evolution of FinOps Automation: Before and After MCP

Before MCP

Traditional FinOps automation relies heavily on predefined rules and human oversight.

Common characteristics include:

Threshold-based alerts

Manual anomaly reviews

Static budget limits

Human approval workflows

Limited cross-platform intelligence

While helpful, these systems struggle with complex trade-offs. They cannot reason across multiple variables such as performance, cost, risk, and business impact.

As a result, optimization remains slow and reactive.

After MCP

With MCP-enabled AI agents, FinOps automation becomes context-aware and adaptive.

Key capabilities include:

Cross-platform reasoning

Continuous optimization

Predictive governance

Autonomous remediation

Business-aligned decisions

Instead of asking, “Did we exceed the budget?”, systems begin asking, “Why is this happening, what is the impact, and what is the best response?”

This marks the shift from automation to intelligence.

Why MCP Is a Game-Changer for FinOps

Unified Financial Context

Today, most FinOps teams operate with fragmented data. Cloud billing lives in provider consoles, usage metrics sit in monitoring tools, allocation data is maintained in spreadsheets, and financial reporting happens in ERP systems. Each team sees only part of the picture.

MCP acts as a common communication layer that allows AI agents to securely access and combine these disconnected sources into a single operational view. Instead of switching between dashboards and manually reconciling reports, teams get a unified, continuously updated financial context.

This eliminates blind spots, reduces reporting inconsistencies, and enables more accurate cost attribution across teams, products, and business units. With a shared source of truth, engineering, finance, and leadership can make decisions based on the same data.

Real-Time Cost Intelligence

Traditional FinOps processes rely heavily on delayed reports. By the time cost anomalies, inefficient workloads, or budget overruns are discovered, the financial impact has already occurred.

With MCP, real-time usage, performance, and billing data can be streamed directly to AI systems. This allows agents to continuously monitor spending patterns and infrastructure behavior as they happen.

As a result, anomalies, unexpected spikes, and underutilized resources can be detected within minutes instead of weeks. AI agents can flag risks early, recommend corrective actions, or even trigger automated responses. This shifts FinOps from reactive cost management to proactive financial governance.

Interoperability Across Tools

One of the biggest barriers to automation in FinOps is integration complexity. Most organizations use a mix of cloud providers, container platforms, SaaS tools, and financial systems, each with its own APIs, formats, and limitations.

MCP is designed to be vendor-neutral and extensible. It provides a standardized way for AI agents to interact with AWS, Azure, GCP, Kubernetes, data platforms, SaaS services, and finance systems without requiring custom-built connectors for every tool.

This dramatically reduces integration effort and ongoing maintenance. Teams can introduce new platforms or migrate workloads without rebuilding their automation stack. More importantly, it future-proofs FinOps operations, ensuring that AI-driven optimization can evolve alongside changing technology environments.

Secure and Governed Access

As AI agents gain deeper access to financial and infrastructure systems, security and governance become non-negotiable. Unrestricted access to billing data, usage metrics, and internal financial systems can introduce serious compliance and operational risks.

MCP addresses this by supporting fine-grained permissions, role-based access controls, and detailed audit trails. Organizations can precisely define what data each AI agent, team, or workflow is allowed to access, down to specific accounts, services, or cost categories.

Every interaction through MCP is logged and traceable, making it easier to meet internal governance standards and external compliance requirements. Finance leaders can review who accessed what data, when, and for what purpose, ensuring transparency across automated workflows.

By enforcing security and governance at the protocol level, MCP allows organizations to scale AI-driven FinOps automation with confidence. AI systems only see what they are authorized to see, making automation not just powerful, but also compliant, trustworthy, and enterprise-ready.

How MCP Powers AI-Driven FinOps Automation

At its core, MCP acts as the connective layer between raw cloud data and intelligent financial decision-making. Instead of relying on manual reports and fragmented tools, MCP enables a continuous, automated feedback loop where AI systems observe, analyze, and optimize cloud spend in real time.

A typical MCP-powered FinOps architecture looks like this:

Data Sources → MCP Layer → AI Agents → Automated Actions

This architecture transforms cloud cost management from a reactive process into a self-optimizing system.

Step 1: Data Collection: Unified Context Ingestion

The first step is gathering financial and operational context from across the organization.

Through MCP, cloud platforms, observability tools, and finance systems expose structured, machine-readable data such as:

Cloud billing and usage data from AWS, Azure, and GCP

Kubernetes and container metrics

Application performance and workload telemetry

SaaS subscription usage and licensing data

Budget forecasts, invoices, and ERP records

Business metrics such as revenue, customer usage, or unit economics

Instead of exporting CSV files or relying on manual integrations, these systems publish their data directly through MCP in a standardized format. This ensures that AI agents always have access to fresh, consistent, and reliable inputs.

Step 2: Context Aggregation: Normalization and Governance

Once data is ingested, MCP acts as a central context layer that organizes and secures it.

In this stage, MCP:

Normalizes billing formats across providers

Maps cloud resources to teams, projects, and products

Resolves missing or inconsistent tags

Aligns usage data with business metadata

Applies access controls and governance policies

This step is critical because raw cloud data is rarely usable in its original form. Without normalization, AI systems would struggle with inconsistent schemas, naming conventions, and fragmented ownership models.

By standardizing and governing this context, MCP presents AI agents with a single, trusted financial and operational view of the environment.

Step 3: AI Reasoning: Intelligent Cost and Value Analysis

With a clean, unified context in place, AI agents can begin reasoning over the data.

At this stage, agents analyze multiple dimensions simultaneously, including:

Historical and real-time cost trends

Resource utilization patterns

Application demand cycles

Budget constraints and financial targets

Internal FinOps policies and governance rules

Business performance metrics

Rather than evaluating costs in isolation, AI systems can understand why spend is changing and how it relates to business outcomes.

For example, agents can determine whether rising infrastructure costs are driven by healthy product growth, inefficient provisioning, unused capacity, or architectural bottlenecks.

They can also simulate scenarios such as:

“What happens if this workload is moved to another region?”

“How will this deployment impact next month’s budget?”

“Which services are at risk of breaching cost thresholds?”

This contextual reasoning is what enables AI to move beyond reporting and into true financial intelligence.

Step 4: Action Execution: From Insight to Automation

Once AI agents reach conclusions, MCP enables them to act directly within approved boundaries.

Based on predefined policies and confidence levels, agents can initiate actions such as:

Rightsizing overprovisioned instances and containers

Scaling down idle or underutilized workloads

Adjusting budget allocations dynamically

Shifting workloads to more cost-efficient regions or providers

Triggering approval workflows for high-impact changes

Updating forecasts and financial dashboards

Notifying stakeholders about emerging risks

These actions can be fully automated, semi-automated (requiring approval), or advisory, depending on organizational maturity and governance preferences.

Importantly, all actions are logged and traceable, ensuring transparency and compliance.

Continuous Optimization: A Self-Improving Cost Control Loop

What makes MCP-powered FinOps fundamentally different is that this process does not run periodically; it runs continuously.

The system operates as a closed feedback loop:

New data flows in through MCP

Context is refreshed and normalized

AI agents reassess conditions

Optimization actions are executed

Results are monitored and learned from

Over time, AI models refine their recommendations based on outcomes, improving accuracy and confidence.

For example, if a rightsizing action consistently leads to performance issues, agents learn to apply more conservative thresholds in similar scenarios. If a particular workload responds well to aggressive optimization, automation becomes more proactive.

This creates a self-learning FinOps system that adapts as infrastructure, pricing models, and business priorities evolve.

From Reactive Management to Autonomous FinOps

With MCP as the foundation, organizations move from:

Manual reporting → Continuous intelligence

Reactive cost control → Predictive optimization

Tool-based workflows → Agent-driven automation

Isolated decisions → Context-aware governance

Instead of spending hours interpreting dashboards and reconciling reports, FinOps teams can focus on strategic initiatives, while AI handles day-to-day optimization at scale.

MCP and the Rise of FinOps Agents

As cloud environments grow more complex, traditional cost management tools are reaching their limits. Static dashboards, periodic reviews, and manual optimization workflows cannot keep pace with dynamic, AI-driven infrastructure.

This gap is giving rise to FinOps agents, specialized AI systems designed to manage financial operations continuously and autonomously.

Unlike general-purpose analytics tools, FinOps agents are built to:

Monitor cloud spend and usage in real time

Interpret financial data in a business context

Apply governance policies automatically

Recommend and execute optimizations

Learn from past outcomes and decisions

With MCP as their foundation, these agents no longer operate in isolation.

Context-Driven Collaboration

Through MCP, FinOps agents can:

Collaborate across technical, financial, and operational domains

Share standardized context between systems

Coordinate decisions based on shared objectives

Learn collectively from historical actions and results

For example, an infrastructure optimization agent can exchange context with a budgeting agent and a performance-monitoring agent. Together, they can determine whether scaling down a workload will impact revenue, customer experience, or compliance requirements.

This creates a networked intelligence model where decisions are informed by multiple perspectives, not just cost metrics.

From Tools to Decision Networks

Instead of managing dozens of disconnected tools and reports, organizations begin deploying multi-agent ecosystems.

In these ecosystems:

Finance agents focus on budgets, forecasts, and margins

Engineering agents focus on utilization and performance

Operations agents focus on reliability and availability

Compliance agents focus on governance and risk

All agents communicate through MCP, aligning their actions toward shared business goals.

As a result, dashboards become secondary. They are replaced by decision networks that continuously assess trade-offs and act in real time.

FinOps evolves from a reporting function into an intelligent, distributed control system for cloud economics.

Benefits for Modern Organizations

Organizations that successfully adopt MCP-powered FinOps automation experience both operational and strategic advantages.

Faster and Smarter Financial Decisions

With unified, real-time context, AI agents eliminate delays caused by manual data collection and reconciliation.

Instead of waiting weeks for reports, teams gain:

Predictive insights into future spend

Automated scenario analysis

This enables leadership to make informed decisions in hours rather than weeks.

Reduced Operational Waste

Continuous monitoring and automated optimization help eliminate inefficiencies such as:

Overprovisioned compute and storage

Idle development environments

Underutilized SaaS licenses

Redundant data pipelines

Unnecessary cross-region transfers

By addressing waste as it emerges, organizations prevent small inefficiencies from compounding into major budget overruns.

Improved ROI on AI and Cloud Investments

As AI workloads and data platforms grow, so do their costs. MCP-powered automation ensures that these investments remain aligned with business value.

Organizations can:

Track unit economics at a granular level

Evaluate AI workloads based on outcomes, not just usage

Optimize models, pipelines, and infrastructure continuously

This turns AI from a cost risk into a measurable growth engine.

Stronger Accountability and Ownership

By mapping costs to teams, products, and business units, MCP enables clear financial ownership.

This leads to:

Greater engineering accountability

Transparent budget ownership

Data-driven performance reviews

Shared responsibility for optimization

Cost management becomes a cultural norm rather than a finance-only activity.

Scalable Governance and Compliance

As organizations scale, manual governance breaks down. MCP enables policies to be embedded directly into workflows.

Examples include:

Enforcing tagging standards automatically

Restricting high-cost resource creation

Applying approval workflows dynamically

Maintaining audit trails for all actions

This ensures compliance without slowing down innovation.

Better Forecasting and Strategic Planning

With historical patterns, real-time signals, and business context unified, AI systems can generate highly accurate forecasts.

Leaders gain:

Early warning systems for overruns

Scenario-based planning tools

Data-backed investment decisions

Most importantly, cost management becomes a strategic capability rather than a defensive function. It evolves into a source of competitive advantage.

Challenges and Considerations

While MCP enables powerful automation, successful adoption requires both technical and organizational maturity.

Without proper foundations, automation can amplify existing problems rather than solve them.

Ensuring High-Quality Data

AI systems depend on accurate, consistent, and complete context.

Common issues include:

Missing or inconsistent resource tags

Incomplete billing data

Unmapped business ownership

Outdated metadata

Fragmented cost centers

If input data is unreliable, AI-generated insights will be equally flawed.

Organizations must invest in data hygiene and governance before scaling automation.

Standardizing Tagging and Metadata

Effective FinOps automation requires a shared language across teams.

This includes standardized:

Project and environment labels

Cost center mappings

Application identifiers

Ownership metadata

Compliance classifications

Without this consistency, MCP cannot reliably connect technical resources to business outcomes.

Standardization is often more challenging than deploying new tools, but it is essential for success.

Integrating Legacy and Fragmented Systems

Many enterprises still rely on:

On-premise infrastructure

Custom billing systems

Manual spreadsheets

Older ERP platforms

Proprietary monitoring tools

Integrating these systems into MCP-based workflows can require significant effort.

Successful organizations approach integration incrementally, prioritizing high-impact systems first.

Managing Organizational Change

Automation changes how teams work and make decisions.

Common challenges include:

Resistance to AI-driven recommendations

Fear of losing control

Lack of trust in automated actions

Skill gaps in FinOps and data literacy

Leadership must invest in training, transparency, and change management to build confidence in AI systems.

Avoiding Over-Automation

Not every decision should be fully automated.

High-risk or strategic actions, such as major architectural changes or long-term commitments, often require human judgment.

Organizations must define clear boundaries between:

Advisory automation

Approval-based automation

Fully autonomous actions

This ensures that automation enhances human decision-making rather than replacing it blindly.

Evolving Governance Models

As automation scales, governance frameworks must evolve alongside it.

This includes:

Updating policies regularly

Reviewing agent behavior

Auditing automated decisions

Refining risk thresholds

Establishing accountability structures

Governance is not a one-time setup; it is an ongoing process.

The Future: Open Protocols and Autonomous Finance

MCP represents a broader shift toward open, interoperable AI infrastructure, where financial intelligence is no longer locked inside proprietary tools, but flows freely across systems.

Over the next few years, we will see:

FinOps Systems Evolve into Autonomous Controllers

FinOps platforms will move beyond reporting and recommendations. They will actively manage budgets, optimize infrastructure, and enforce policies in real time, much like autonomous systems manage traffic or energy grids today.

Cost Governance Embedded in Every Workflow

Instead of being a separate function, cost governance will become part of daily operations. From code deployment to data processing, every workflow will carry built-in financial awareness and guardrails.

AI-Driven Procurement and Budgeting

Procurement, vendor selection, and contract management will increasingly be guided by AI systems that analyze performance, usage patterns, and long-term value. Budgets will adjust dynamically based on real-time business conditions.

Real-Time Economic Optimization

Organizations will continuously balance performance, cost, and risk. AI agents will evaluate thousands of micro-decisions, where to run workloads, which models to use, when to scale, to maximize economic efficiency at every moment.

Finance Becoming Software-Defined

Just as infrastructure became programmable, finance will become programmable as well. Policies, approvals, forecasts, and controls will be managed through code and intelligent agents rather than manual processes.

Organizations that embrace open standards early will be better positioned to build resilient, adaptive, and future-ready financial systems, capable of scaling alongside AI, cloud, and digital transformation.

The Evolution from Human-Driven FinOps to AI-Led Governance

FinOps is entering a new era.

Manual reviews, static reports, and isolated tools cannot keep pace with AI-driven, multi-cloud environments. You need intelligent automation, and MCP provides the foundation for this transformation by giving AI systems secure, standardized access to financial context.

With it, organizations can move from reactive cost management to proactive, autonomous governance. In the age of AI-native infrastructure, the future of FinOps belongs to those who combine open protocols, intelligent agents, and strong financial observability.

[Request a demo and speak to our team]

[Sign up for a no-cost 30-day trial]

[Check out our free resources on FinOps]

[Try Amnic AI Agents today]

Frequently Asked Questions

1. What is MCP in FinOps and cloud cost management?

MCP (Model Context Protocol) is an open standard that enables AI systems to securely access, share, and analyze financial, usage, and operational data across cloud and SaaS platforms for automated FinOps management.

2. How does MCP support AI-driven FinOps automation?

MCP provides structured, real-time context to AI agents, allowing them to analyze cloud spend, detect anomalies, optimize resources, and execute governance actions automatically.

3. Is MCP compatible with AWS, Azure, and Google Cloud?

Yes. MCP is vendor-neutral and designed to work across major cloud providers, Kubernetes environments, SaaS tools, and enterprise finance systems.

4. How is MCP different from traditional FinOps tools?

Traditional FinOps tools focus on dashboards and reports. MCP enables autonomous AI agents that continuously monitor, reason, and optimize cloud costs in real time.

5. Is MCP secure for enterprise financial data?

Yes. MCP supports fine-grained access controls, audit trails, and governance policies to ensure AI systems only access authorized data.

6. Can MCP help reduce cloud and AI infrastructure costs?

By enabling real-time optimization, automated rightsizing, and intelligent workload management, MCP helps organizations reduce waste and improve ROI on cloud and AI investments.

7. Do organizations need advanced FinOps maturity to use MCP?

While MCP works best in mature environments, organizations at any stage can adopt it gradually by improving data quality, tagging, and governance practices.

8. Will MCP replace FinOps teams?

No. MCP augments FinOps teams by automating routine tasks, allowing professionals to focus on strategy, governance, and business alignment.

Recommended Articles

8 FinOps Tools for Cloud Cost Budgeting and Forecasting in 2026

5 FinOps Tools for Cost Allocation and Unit Economics [2026 Updated]