January 12, 2026

8 FinOps Tools for Cloud Cost Budgeting and Forecasting in 2026

10 min read

If your cloud bill has ever caught you off guard, you’re not alone. As businesses scale and digital footprints grow, cloud infrastructure becomes a vital backbone, but also a volatile expense. Gone are the days when infrastructure costs could be locked down annually. Today, costs shift daily based on deployment choices, user behavior, and product velocity.

Despite its transformative potential, cloud introduces a kind of fiscal unpredictability. Resources scale dynamically, new services are spun up in minutes, and engineering teams ship faster than finance teams can react. It’s no wonder then that 84% of organizations identify managing cloud spend as a top challenge, according to Flexera’s 2024 State of the Cloud Report.

In such a scenario, budgeting and forecasting must be continuous, collaborative, and deeply integrated with engineering and product operations. Without this foundation, organizations risk inefficiency, surprise overruns, and poor strategic decisions.

In this blog, we’ll explore:

Why budgeting and forecasting are essential to cloud success

The risks of operating without them

And 8 FinOps tools that can transform how you forecast, budget, and ultimately control your cloud spend

Let’s dive in.

Why cloud cost budgeting and forecasting matter, now more than ever

The shift from traditional CapEx models to dynamic OpEx-based cloud consumption means businesses now have financial accountability. Every instance, every API call, and every storage byte contributes to costs that fluctuate minute-by-minute.

Here’s why cloud cost budgeting and forecasting matter more than ever:

Financial predictability: Forecasting enables cloud teams to predict future usage and align it with business goals. Businesses have to ensure that resources are used where they create value.

Cost accountability: With clear budgets, teams understand the financial implications of their architectures and deployment choices.

Improved collaboration: Forecasting breaks down silos. Engineering, finance, and leadership speak the same language when there’s a shared view of projected spend.

Better negotiations: Accurate forecasts can help secure reserved instances or committed use discounts from cloud providers.

Proactive scaling: Anticipating costs helps avoid sudden budget shocks, especially during product launches or migrations.

What’s changed in 2026 is the expectation. Leadership teams now expect forecasts to answer questions like:

How will infrastructure costs scale with revenue?

What happens to budgets if usage spikes or workloads shift?

Can teams proactively course-correct before overruns happen?

This is where traditional budgeting models fall short and where modern FinOps tools are stepping in with dynamic, usage-driven forecasting and AI-assisted insights.

What happens when businesses don’t budget and forecast cloud spend?

Neglecting budgeting and forecasting can cause serious ripple effects across an organization, and you really don’t want to get into all that.

Runaway cloud costs: Without clear budget boundaries or proper cost visibility, teams often continue provisioning resources unchecked. These unchecked expenses accumulate quickly, and then you have a shocking end-of-month bill that no one saw coming. In extreme cases, organizations are forced to retroactively cut usage, leading to service disruptions or delays.

Misaligned priorities: In the absence of financial guidance, engineering teams tend to optimize for performance and speed, not cost. While these are valid priorities, they often conflict with financial goals. Without shared forecasting models, engineering might overprovision compute power, unaware of the budget strain this causes.

No ownership or accountability: When spend isn’t tied back to specific teams, features, or business units, there’s no clear accountability. Costs get buried in aggregated bills, and no one feels responsible for overspending. This lack of ownership discourages proactive cost control and promotes a culture of reactive firefighting.

Inaccurate business planning: Finance teams rely on predictability. Without reliable cloud forecasts, it becomes impossible to plan quarterly budgets or allocate capital effectively. This makes it difficult to assess unit economics, evaluate the ROI of cloud-driven initiatives, or prepare for scaling events like product launches.

Missed optimization windows: Cloud providers offer discounts, rightsizing opportunities, and savings plans, but these require foresight. Without predictive forecasting, teams miss windows to commit to lower-cost plans or optimize architecture. By the time cost overruns are noticed, it's often too late to apply efficient solutions.

A lack of foresight can be the difference between scaling confidently and spiraling into cost chaos.

What to look for in a FinOps tool for budgeting and forecasting?

Before we dive into the tools, it’s worth asking:

What makes a FinOps platform truly effective for budgeting and forecasting in a dynamic cloud environment?

In 2026, cloud budgeting and forecasting look very different from a few years ago. Teams are managing multi-cloud setups, Kubernetes workloads, data platforms, and increasingly, AI-driven infrastructure. Static budgets and spreadsheet-based forecasts simply can’t keep up with this level of complexity.

A great FinOps tool for budgeting and forecasting should feel less like a reporting system and more like a co-pilot. It should help teams anticipate spend, adjust quickly when things change, and keep Finance, Engineering, and Product aligned without constant manual effort. Here’s what that looks like in practice.

Cloud cost visibility with real-time context

You can’t budget or forecast effectively if you don’t have clear visibility into what’s happening right now. A strong FinOps tool provides real-time visibility into cloud usage and costs across accounts, services, and environments.

More importantly, in 2026, visibility shouldn’t stop at raw spend. Teams need business context, such as cost by team, workload, or product, so forecasts are tied to how the business actually operates, not just to infrastructure components.

Flexible and granular budgeting controls

Cloud budgets need to reflect how organizations are structured. Look for FinOps tools that allow budgets to be created and managed at multiple levels, by team, product, customer segment, or cloud service.

This flexibility ensures accountability across teams and makes it easier to understand which areas are driving spend. Modern tools also support scenario-based budgeting, enabling teams to model “what-if” situations like usage spikes, new launches, or architectural changes before those costs hit production.

Data-driven and adaptive forecasting

Effective forecasting is built on historical usage data, trend analysis, and seasonality. In 2026, the best FinOps tools go a step further by continuously adapting forecasts as usage patterns change.

Many platforms now use AI-assisted models to refine projections over time, helping teams move away from one-time estimates and toward rolling, usage-driven forecasts. This allows organizations to plan ahead with greater confidence and avoid last-minute budget overruns.

Automated anomaly detection and early alerts

Even the most accurate forecasts can be disrupted by unexpected events. That’s why automated anomaly detection is a critical part of modern FinOps tooling.

Look for tools that can intelligently detect unusual cost behavior, whether it’s a sudden spike in usage, a misconfigured resource, or an unexpected deployment. Early alerts help teams take action quickly and adjust budgets or forecasts before small issues become major financial surprises.

Role-based dashboards and reporting

Different teams care about different things. Finance teams focus on budgets and forecasts, engineering teams care about services and efficiency, and leadership wants to understand business impact.

A good FinOps tool should tailor dashboards and reports to each role, delivering relevant insights without overwhelming users with unnecessary detail. In 2026, these insights are increasingly expected to be generated on demand, without manual report building or constant back-and-forth between teams.

Seamless integration with modern cloud environments

Finally, budgeting and forecasting tools must integrate deeply with today’s cloud ecosystems. This includes direct integrations with AWS, Azure, GCP, and Kubernetes, as well as support for modern workloads like containers, data platforms, and AI-driven services.

Tight integration enables more accurate forecasting, deeper analysis, and automated actions, such as enforcing budgets, adjusting forecasts, or triggering optimization workflows, without adding operational overhead.

8 FinOps Tools You Definitely Need for Budgeting and Forecasting

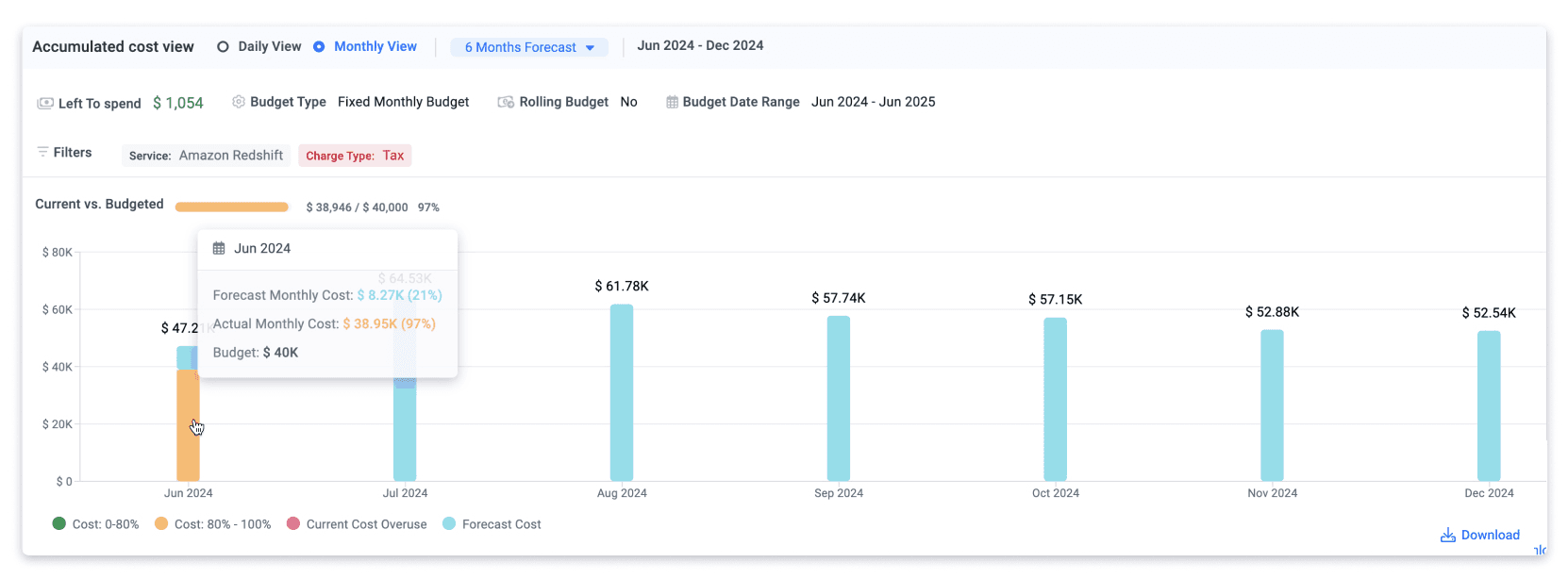

1. Amnic

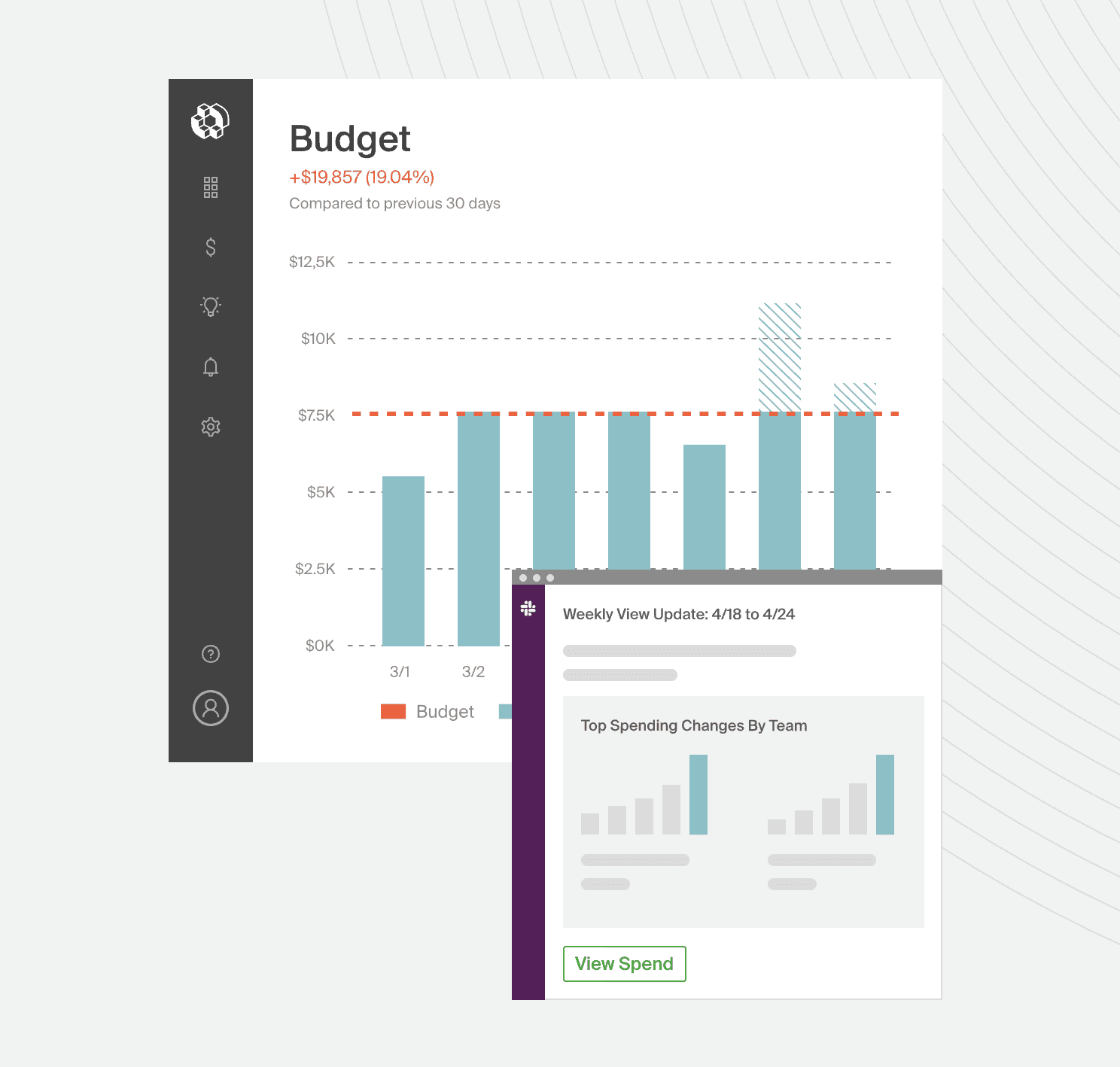

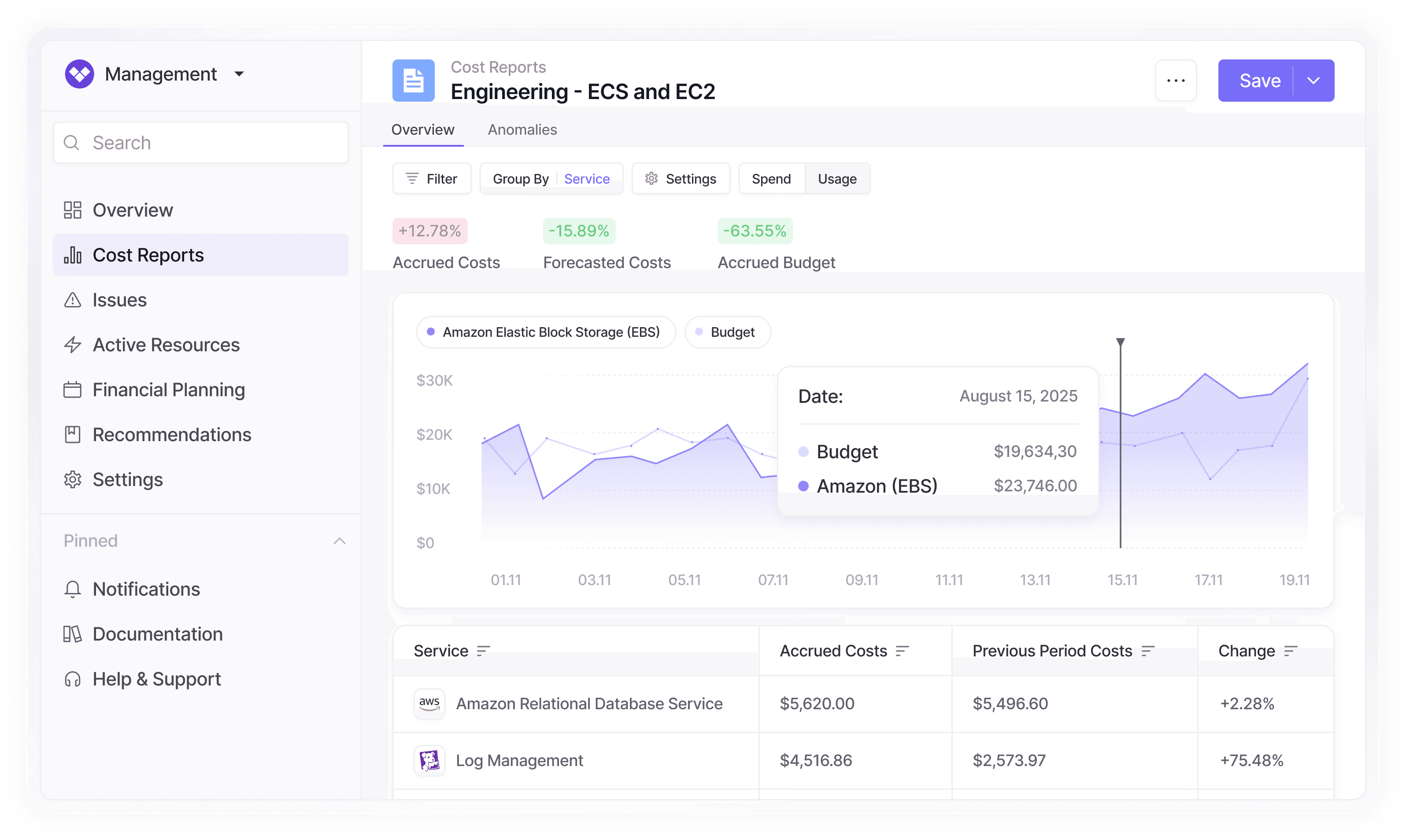

Amnic is a FinOps OS powered by AI Agents, helping businesses gain clarity on every dollar of their cloud spend. Amnic’s AI Agents empower teams to simplify daily FinOps processes without manual heavy lifting. It’s trained to perform tasks on behalf of teams while minimizing time spent on the dashboard and repetitive work.

Teams can automate the core workflows of modern FinOps, from cloud cost diagnostics and anomaly detection to reporting and budget alignment. Empower every stakeholder with role-specific insights, delivered in natural language.

Amnic is built for teams who need to:

Understand how and where cloud costs are growing

Track trends, organize, explore, and interact with data with custom dashboards

Get context-aware recommendations based on industry best practices

Catch cloud cost anomalies and trigger alerts before they affect the bottom line

Allocate costs to specific apps, services, business units, or teams

Build and share audit-ready, persona-specific cloud cost reports in minutes

Map and distribute budgets across teams and departments so each team has the necessary budgets they need without unexpectedly exceeding limits.

Customize projections across specific date ranges, from monthly to quarterly or beyond, to proactively manage expenses based on precise timelines.

With Amnic, businesses can identify configuration drift, alert teams, and take action before it impacts budgets or compliance.

2. Apptio Cloudability

A widely adopted enterprise FinOps platform, Cloudability delivers powerful budgeting, forecasting, and cost optimization tools. It helps teams create forecasts based on historical trends, build driver-based planning models, and set budgets with real-time alerts. Users can define views that map to organizational structures, monitor month-to-date spend, and receive early warnings when spend approaches thresholds.

Key strengths:

ML-driven forecasting and historical trend analysis

Driver-based planning modules for flexible scenario modeling

Budget showback/chargeback capabilities aligned to organizational views

Rich dashboards and custom reports for finance and procurement teams

3. CloudHealth by VMware (Tanzu CloudHealth)

CloudHealth provides robust governance, budgeting, and forecasting across multi-cloud environments. Using historical usage data and ML, it projects future cloud costs for up to 36 months and integrates business-enriched inputs to improve forecast accuracy.

Key Features:

Machine learning-powered forecasts with seasonality and growth factors

Budget policy enforcement with threshold alerts

Chargeback and showback capabilities via dynamic business groupings (“Perspectives”)

Governance automation aligned to spending goals

Also read: Why Every Business Needs a Cloud Cost Allocation Tool?

4. CloudZero

CloudZero stands out for its business-aligned cloud cost insights, helping SaaS and product teams forecast based not just on spend but on unit economics like cost per feature or customer.

Core capabilities:

Real‑time allocation of cloud cost per customer, feature, team, or project

Forecast models built around business growth rather than raw usage trends

Unit economics insights to drive decisions on pricing, alignment, and profitability

Also read: The Definitive Guide to SaaS Unit Economics: Mastering Unit Cost Calculation

5. Vantage.sh

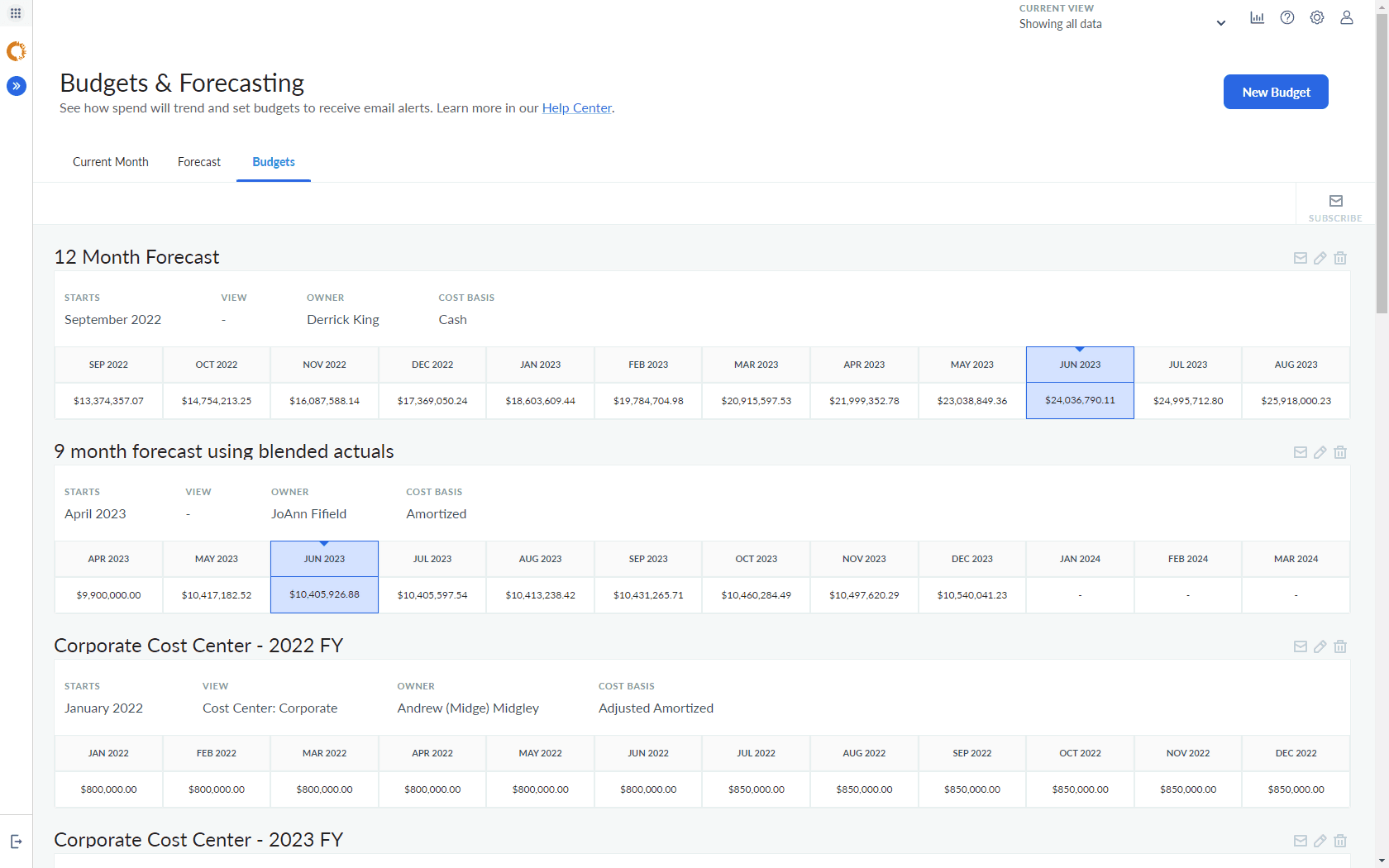

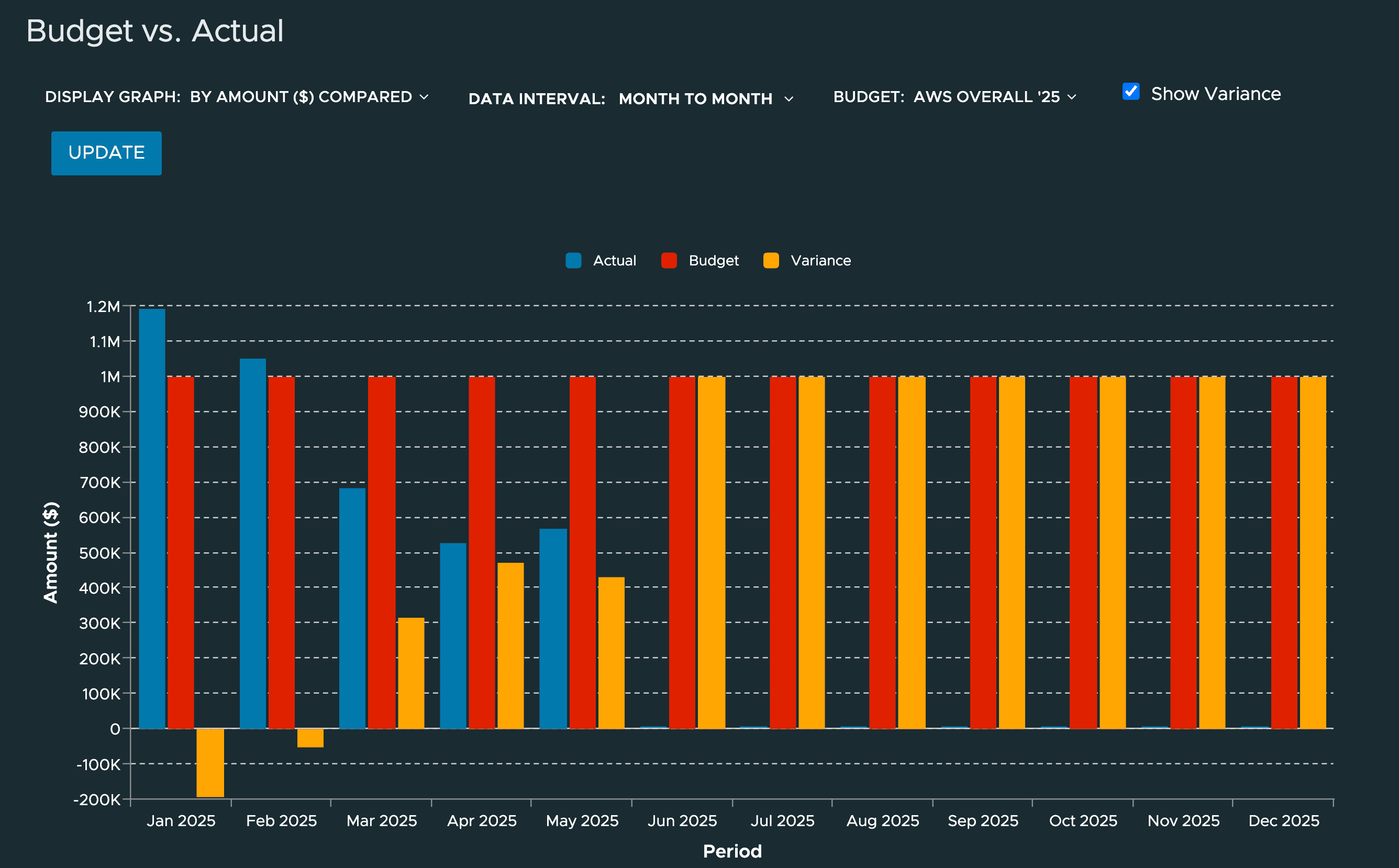

Vantage offers a comprehensive budgeting system designed to help organizations manage and monitor cloud spend with precision. Businesses can create monthly budgets, plan quarterly forecasts, or sync with finance teams during annual cycles. Vantage allows teams to allocate budgets across organizational units, receive alerts, and maintain financial discipline across cloud environments.

Key highlights:

Create and assign budgets to cost reports and track accrued vs. budgeted costs.

Get notified via Slack, Email, or Microsoft Teams when spending trends exceed set thresholds, with quick access to investigate further.

Set multiple, tiered alert levels using natural language terms to match your team’s budget tolerance and risk appetite.

Model your organization’s structure using parent-child relationships, making it easier to roll up or drill down into budget allocations across departments or teams.

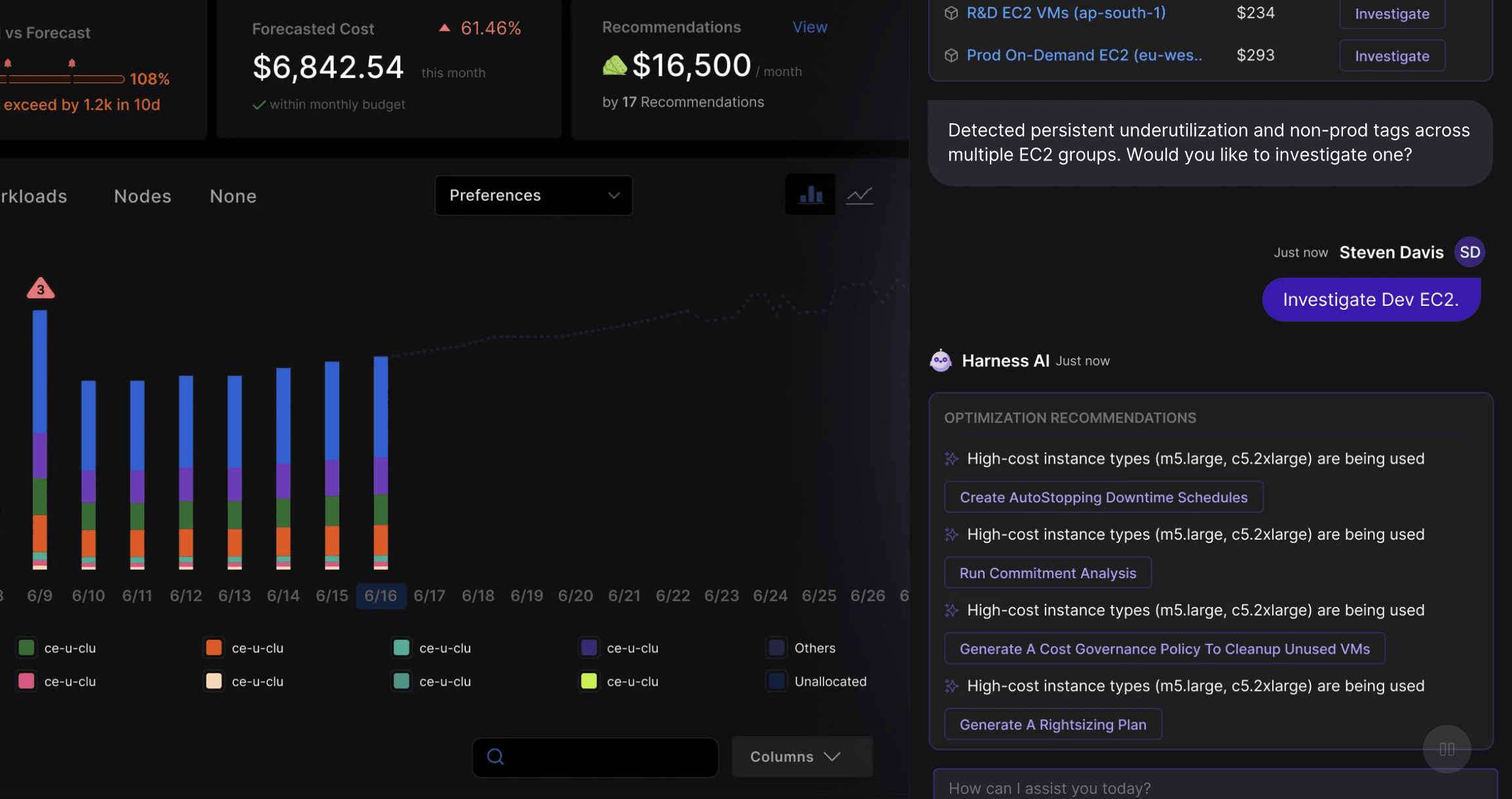

6. Harness Cloud Cost Management (CCM)

Harness CCM delivers cost visibility and forecasting directly within DevOps workflows, making insights actionable for engineering teams.

Key capabilities:

Hourly visibility and forecasting tied to namespaces, workloads, and deployments

Hierarchical budgets with real-time alerts across daily, monthly, and quarterly timeframes

Budgeting integrated into CI/CD pipelines for proactive cost control

Recommendations to reduce spend based on deployment patterns

Also read: Cloud Spending Visibility Strategies, Challenges and the Ultimate Checklist

7. Kubecost

Kubecost is the go-to for Kubernetes-native organizations, offering real-time cost tracking, forecasting, and resource-level budgeting tailored to container environments.

Feature highlights:

Real-time tracking and forecasting of costs down to pod, namespace, and label levels

Budget and target enforcement with alerts at granular Kubernetes entity levels

Predictive cost modeling for new deployments based on resource-hour rate modeling

Open-core with enterprise add-ons for advanced governance and RBAC.

UmbrellaCost, the business unit born from Anodot’s cloud cost solution, utilizes machine learning to deliver predictive cost insights and adaptive forecasting for cloud environments.

Rather than relying on fixed thresholds, Anodot continuously learns usage patterns to detect anomalies early and forecast future spend with higher accuracy. This makes it particularly useful for teams managing volatile or high-growth cloud workloads.

Key strengths:

ML-driven forecasting models

Real-time anomaly detection

Adaptive alerts tied to cost behavior

Strong complement to FinOps budgeting workflows

Anodot is commonly used alongside FinOps tools to enhance forecasting accuracy and anomaly response.

Final Thoughts

As cloud usage continues to evolve in 2026, budgeting and forecasting can no longer be static or manual processes. Modern FinOps tools are enabling teams to forecast dynamically, respond to change faster, and align cloud spend directly with business performance.

Choosing the right tool depends on your organization’s scale, cloud maturity, and collaboration needs, but the goal remains the same: predictable, explainable, and business-aligned cloud spending.

Ready to budget and forecast smarter?

Whether you’re a fast-growing startup or a cloud-native enterprise, the right tools can help you move from guesswork to strategy.

Get started with Amnic:

[Explore Amnic’s Budgeting and Forecasting Features]

[Download the FinOps Resources]

Recommended Articles

FAQs: FinOps Tools for Budgeting and Forecasting

Q1: Why are budgeting and forecasting critical for cloud cost management?

Cloud budgeting and forecasting help organizations stay ahead of unpredictable spend by aligning costs with business goals. With proper planning, teams can prevent budget overruns, make informed trade-offs, and scale cloud usage responsibly. It also improves collaboration between finance and engineering by bringing financial visibility into day-to-day cloud decisions.

Q2: What are the risks of not using proper FinOps tools for budgeting and forecasting?

Without the right FinOps tools for budgeting and forecasting, organizations face budget surprises, delayed reporting, and siloed decision-making. Engineering may overprovision resources, finance might miss spend anomalies, and leadership lacks real-time visibility, all of which lead to poor ROI on cloud investments.

Q3: What should I look for in a cloud cost budgeting and forecasting tool?

An effective FinOps tool for budgeting and forecasting should offer:

Granular visibility across services and cloud providers

Budget creation with customizable thresholds

Forecasting using actual usage patterns

Persona-based dashboards and alerts

AI assistance for summarizing trends and detecting anomalies

FinOps tools like Amnic go a step further by offering all of this in one place, with AI agents that do the heavy lifting.

Q4: How do Amnic’s AI Agents help with budgeting and forecasting?

Amnic’s AI agents like Governance Agent and Reporting Agent simplify FinOps workflows by automatically surfacing trends, alerting on budget thresholds, and generating stakeholder-ready reports. They reduce the need for manual effort and bring role-specific context, making budgeting and forecasting faster, smarter, and more accurate.

Q5: Can I use Amnic’s budgeting features across multiple cloud providers and teams?

Yes. Amnic supports AWS, Azure, GCP, Kubernetes, and more. You can create unified budgets across services, accounts, business units, and even shared infrastructure. Hierarchical budgets, imports from finance tools, and team-level alerts make it easy to scale cost governance across your organization.

Q6: How fast can I get started with Amnic’s budgeting and forecasting tools?

You can set up Amnic in under five minutes. The platform automatically ingests your cloud billing data, applies intelligent grouping, and provides out-of-the-box dashboards, recommendations, and budget alerts tailored to your needs.

Q7: How does Amnic support finance, engineering, and leadership differently?

Finance teams get forecast accuracy, budget alerts, and cost allocation by business unit.

Engineering teams receive environment-level diagnostics, usage breakdowns, and cost summaries tied to workloads.

Leadership sees top-level trends, ROI metrics, and cost summaries aligned with business goals.

Amnic delivers these through persona-specific dashboards and reports.