November 24, 2025

The Top 7 Cloud Cost Trends of 2025 (and What to Expect in 2026)

10 min read

In 2025, we witnessed teams move beyond dashboards as FinOps became autonomous.

AI workloads scaled in seconds, GPU clusters spun up and down across regions, and data-transfer-heavy architectures drove 30-50% of surprise spending in many organizations. Traditional FinOps practices, which included manual tagging reviews, monthly allocation cycles, and spreadsheet forecasting, just couldn’t keep up.

This is the year FinOps AI Agents stepped into the center of cloud financial management.

Instead of engineers reacting to anomalies after the bill arrived, FinOps AI agents predicted cost spikes before they happened. Instead of analysts digging through cost reports, AI detected unused resources, and recommended rightsizing based on real usage patterns. Instead of finance teams waiting for engineering updates, proper governance alerts created instant alignment across teams and instead of one persona trying to interpret another's data, AI now generates stakeholder-ready reports with the right level of context for finance, engineering, product, and leadership.

Across the industry, companies like AWS, Google Cloud, and Azure began rolling out AI-powered cost tools, and third-party platforms brought even more autonomy from anomaly triage to corrective actions. Analysts started calling 2025 “the year cloud cost management became AI-native,” with more than 60% of enterprises reporting that they now use some form of automation or AI assistance in their FinOps workflows, according to a report by TechRadar.

This shift is exactly where Amnic has been leading the curve. With FinOps AI Agents that forecast spend, detect anomalies, highlight hidden drivers, and guide optimization automatically, teams across finance, engineering, and leadership are moving from reactive cost control to predictive, AI-driven decision-making.

In 2026, this transformation only accelerates. Cloud cost management won’t just be monitored, it will be governed, enforced, and optimized by intelligent systems that operate in real time.

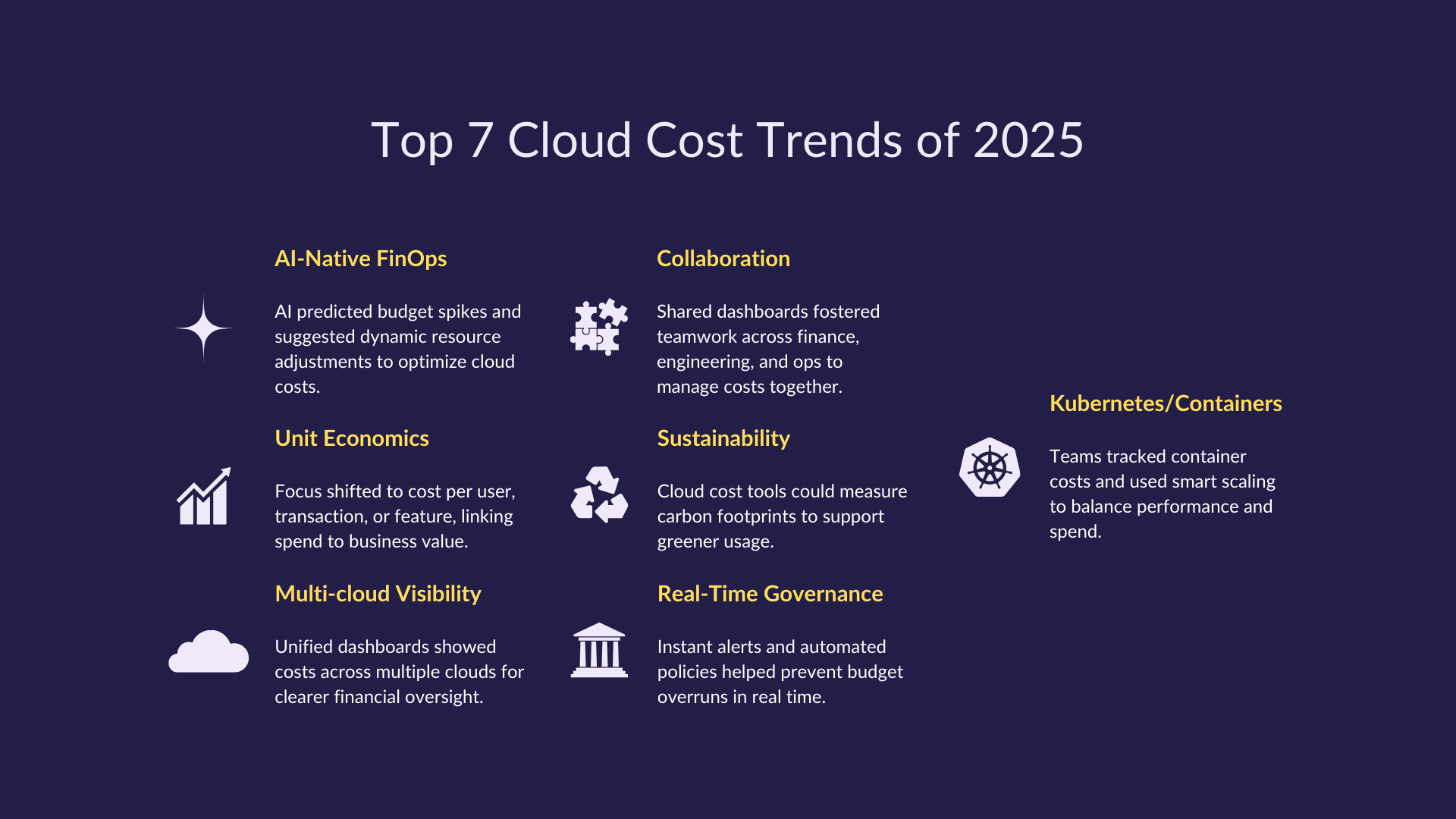

The 7 Trends That Defined Cloud Cost Management in 2025

Here are the major cloud cost trends we observed in 2025, and how they’re shaping the future of FinOps and cloud finance.

1. FinOps went AI-native

AI is no longer a “preference” for cloud cost management; it’s now an integral part of it. In 2025, organizations increasingly utilized AI-driven forecasting, anomaly detection, and rightsizing.

AI models helped predict sudden cost spikes (e.g., a data team launching a big training job) and alerted teams before they impacted the budget.

Machine learning was used to recommend rightsizing actions dynamically, scaling down idle or underutilized resources with data-backed confidence.

According to cloud FinOps statistics, nearly 48% of FinOps teams adopted AI-driven anomaly detection tools in 2025.

Academic frameworks, like reinforcement-learning–based resource allocation, showed that AI can reduce cloud spend by 30-40% compared to manual provisioning.

AI-powered agents can proactively surface optimization opportunities, detect irregularities in spend, and recommend or even automate changes, essentially turning FinOps from reactive reporting into predictive governance.

2. Value over vanity: The rise of unit economics

More teams started evaluating cloud costs based on unit economics, cost per user, cost per transaction, or cost per feature, rather than just looking at the total monthly bill.

This trend reflects a more mature FinOps approach: not just saving money, but driving business outcomes.

Cost-allocation tools made a major difference: mapping every dollar to specific workloads or business metrics helped stakeholders see which teams truly generate value.

On the market side, as FinOps adoption grew, more platforms began offering granular cost allocation and showback/chargeback capabilities, and 58% of teams implemented these models to promote financial ownership.

With precise cost attribution, Amnic helps teams translate cloud spend into business KPIs, enabling conversations like, “This feature costs $0.05 per transaction, and here’s how that impacts profitability.”

3. Multi-cloud visibility became non-negotiable

As multi-cloud strategies mature, unified visibility across providers emerged as a critical need.

According to industry analysis, 87% of organizations now pursue multi-cloud strategies.

Yet, many struggle to govern costs across clouds: different billing models, tag structures, and metrics make it hard to get a consolidated financial view.

Reports on cloud cost optimization emphasize that without structured FinOps and cross-cloud dashboards, cost waste is inevitable.

Multi-cloud dashboards help unify metrics from AWS, GCP, Azure, and more, giving teams a single pane of glass to monitor costs, set policies, and enforce tagging across clouds.

4. Kubernetes costs came into focus

Containers and Kubernetes are now mainstream, but their cost profiles are more complex than VMs, and in 2025, teams started putting more effort into understanding and optimizing them.

With autoscaling, ephemeral workloads, and unpredictable usage patterns, Kubernetes costs were no longer a black box.

FinOps practitioners adopted percentile-based rightsizing (P95, P90, etc.) to balance cost vs. performance, rather than applying static thresholds.

Research supports this shift: a study comparing network costs in Kubernetes clusters versus other infrastructure showed non-trivial network spend that many teams underestimate.

By integrating Kubernetes observability, platforms can track container-level spend, monitor scaling behaviors, and provide rightsizing insights based on real usage percentiles, which helps FinOps teams optimize without risking performance.

5. Governance went real-time

In 2025, cloud cost governance didn’t just live in spreadsheets, it was embedded into workflows and enforced in real time.

Organizations moved from static budget tracking to active governance: real-time policies, guardrails, and alerts.

FinOps maturity advanced: only a subset of companies had “advanced” frameworks, but many were automating more than before. According to recent stats, enterprises with mature FinOps systems saw 40% better budget accuracy year-over-year.

Cloud cost optimization reports highlighted that real-time enforcement (rightsizing, budget alerts) is now a core capability for effective FinOps.

Platforms can enforce cost policies dynamically, enabling role-based views and shared dashboards, so finance, engineering, and leadership all have the right guardrails and shared visibility.

6. Sustainability became a cost metric

The conversation shifted: cloud optimization is no longer just about money, but also environmental impact.

Analysts note a growing demand for “green FinOps”, FinOps practices that incorporate carbon footprint and energy efficiency into cloud decision-making.

According to industry insight, cost optimization is being merged with sustainability initiatives, enabling teams to align cloud usage with ESG goals.

Hybrid cloud and multi-cloud strategies are being evaluated not only for performance and cost, but also for emissions impact.

By visualizing efficiency metrics alongside spend, platforms help teams pinpoint over-provisioned or idle workloads that waste both money and carbon, enabling sustainable optimization decisions.

7. Collaboration became the new KPI

FinOps maturity in 2025 was increasingly measured by how well teams worked together, more than just about raw savings.

The most successful FinOps teams were those that dissolved silos: finance, engineering, product, and operations aligned around shared dashboards and cost ownership.

Tools evolved to support this collaboration through cross-role tagging, shared views, and unified reporting, enabling stakeholders to make decisions based on a single source of truth.

In vendor reports and practitioner forums, FinOps is now framed as both a cultural and operational practice. So, now it’s more than just a cost-saving initiative.

By offering role-aware insights and shared cost contexts, Amnic (or similar platforms) helps break down organizational barriers so that decisions are owned by the right people and based on shared data.

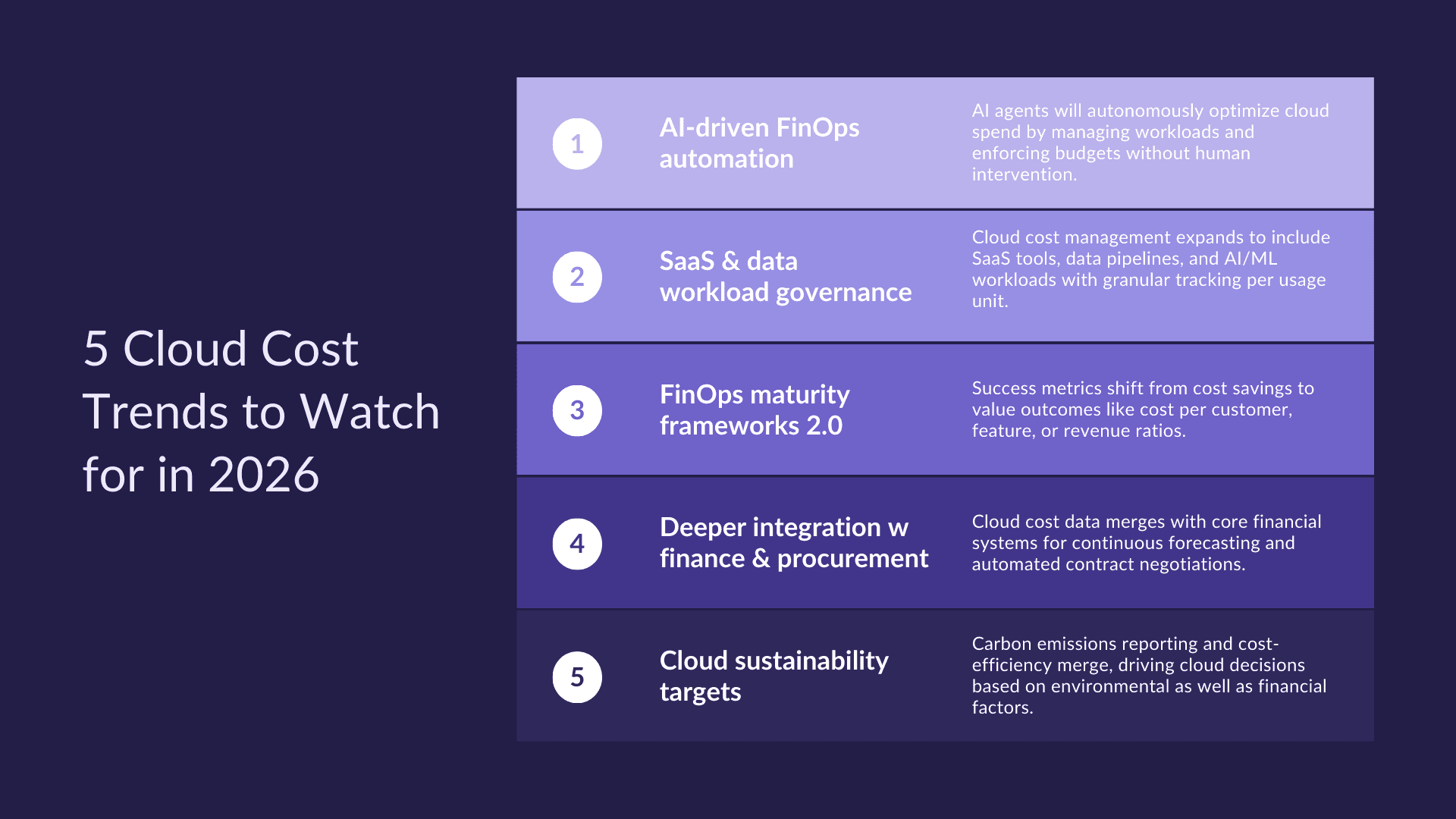

5 Cloud Cost Management Trends to Watch for in 2026

As cloud environments get larger, more distributed, and more AI-heavy, the way organizations manage spend will evolve just as fast. Here’s what’s expected to shape FinOps and cloud cost management in 2026:

1. AI-driven FinOps automation

2026 will be the year AI agents stop being “assistants” and start becoming “executors.” Most organizations today rely on AI for recommendations: rightsizing, idle resource detection, or anomaly predictions. In 2026, these systems will begin to act autonomously based on guardrails set by engineering and finance.

This includes:

Automatically pausing or terminating idle workloads

Auto-scaling clusters based on real-time usage, not static thresholds

Enforcing budget limits by blocking over-provisioning

Triggering alerts only for spend that impacts business KPIs

The shift moves FinOps from reactive cost control to continuous, self-driving optimization.

2. SaaS & data workload governance

In 2026, cloud cost visibility will no longer stop at compute, storage, and networking.

Three categories will dominate:

SaaS spend (marketing tools, sales CRMs, security tools, engineering SaaS)

Data pipeline costs (ETL, warehousing, real-time streaming systems)

AI/ML workloads (vector databases, GPU clusters, inference jobs)

This expansion forces organizations to treat every recurring technology expense, not just cloud infrastructure, as part of their FinOps practice. Expect granular unit cost KPIs for SaaS seats, per-pipeline cost tracking, and per-model inference costs to become standard.

3. FinOps maturity frameworks 2.0

The traditional maturity model (crawl-walk-run) focused heavily on:

savings captured

waste eliminated

budget compliance

In 2026, maturity will be judged by value outcomes, not operational hygiene.

New KPIs entering the conversation:

Cost per customer

Cost per feature/deploy

Cost per workload or per transaction

Cost-to-revenue ratios for product lines

As businesses adopt AI and microservices-heavy architectures, these value metrics become more meaningful than “we saved X% last quarter.”

4. Deeper integration with finance & procurement

FinOps is steadily becoming part of mainstream financial operations.

By 2026:

Cloud cost data will feed directly into ERP platforms, FP&A tools, and procurement systems.

Forecasting cycles will shift from quarterly to continuous, powered by AI trend models.

Engineering and finance will share the same dashboards, built on the same cost datasets.

Cloud contract negotiations (commits, RIs, SPs) will rely on automated usage modeling instead of guesswork.

This merging of FinOps with core financial processes moves cloud spend from a “technical problem” to a strategic business function.

5. Cloud sustainability targets

According to the FinOps Foundation’s Cloud Sustainability Framework, sustainability is becoming a core FinOps capability and a key driver of efficiency. ESG pressures and internal initiatives will make sustainability inseparable from cloud optimization.

By 2026:

Cloud emissions (Scope 2 and parts of Scope 3) will be reported alongside cost KPIs.

“Carbon cost per workload” will become a standard measure.

Engineers will receive recommendations weighted for both cost and emissions, e.g., “shift this workload to region X for 15% lower carbon intensity.”

Organizations will choose cloud providers and regions based on renewable energy availability and carbon reporting transparency.

Sustainability becomes both a compliance requirement and an efficiency driver.

Concluding thoughts

2025 marked a turning point. With advanced tools, AI-driven insights, real-time governance, and shared accountability, FinOps finally became a strategic enabler rather than just a cost discipline.

In 2026, instead of reacting, organizations will operate proactively: automating, predicting, and optimizing in real time, embedding cost intelligence into every workflow. The rise of sustainable metrics, SaaS cost governance, and deeper financial integration means FinOps won’t just be about trimming spend; it will be about driving business value with every cloud decision.

Amnic will continue to lead this shift by providing unified visibility, contextual insights, and role-based control. Amnic helps teams move from blind cost-cutting to confident, collaborative, and proactive cloud economics.

Wish to take Amnic for a spin?

[Request a demo and speak to our team]

[Sign up for a no-cost 30-day trial]

[Check out our free resources on FinOps]

[Try Amnic AI Agents today]

Frequently Asked Questions

1. Why did cloud cost management change so dramatically in 2025?

Because cloud environments became more dynamic and AI-heavy. GPU clusters, data pipelines, and autoscaling workloads made costs spike unpredictably, which forced organizations to move from manual FinOps processes to AI-driven forecasting, anomaly detection, and automated optimization. 2025 marked the first year where AI-native tools became mainstream across FinOps teams.

2. What does “AI-native FinOps” actually mean?

AI-native FinOps refers to using machine learning models and autonomous agents to monitor, predict, and optimize cloud spend in real time. Instead of humans manually reviewing dashboards or resolving anomalies, AI systems forecast trends, surface hidden cost drivers, recommend rightsizing, and soon, in 2026, will even take corrective actions automatically.

3. Why are unit economics becoming more important than total cloud spend?

Total cloud spend doesn’t tell teams whether they’re running efficiently or profitably. Unit economics measures cost per user, per transaction, or per feature, helping organizations tie spend to business value. As SaaS and AI-driven architectures grow, unit metrics make it easier to understand ROI, evaluate product decisions, and align engineering with finance.

4. How is Kubernetes impacting cloud cost visibility?

Kubernetes introduces dynamic and ephemeral workloads, making traditional cost tracking inaccurate. Autoscaling, node overprovisioning, and network-heavy microservices often cause unexpected spend. That’s why percentile-based rightsizing (P95, P90) and container-level visibility became major FinOps priorities in 2025 and will continue to grow in 2026.

5. What’s the biggest cloud cost management shift expected in 2026?

The move from AI-assisted to AI-executed FinOps. In 2026, AI agents are expected to take autonomous actions: pausing idle workloads, scaling resources, enforcing budgets, and managing SaaS/data pipeline costs. This moves organizations from reactive firefighting to continuous, real-time cost governance driven by intelligent automation.