February 20, 2026

Reflecting on the 2026 State of FinOps Report

8 min read

Every year, the FinOps Foundation releases its State of FinOps report, a pulse check of how teams around the world are managing and thinking about technology spend. It’s one of the clearest signals of where cloud, AI, and tech cost strategy are actually headed.

And each year, the story gets bigger.

In 2026, one thing is clear: FinOps isn’t just about cloud bills anymore. It’s shaping how organizations think about technology investments, before the spend even happens.

What started as a practice focused on understanding and optimizing cloud bills has evolved into something much bigger. AI is accelerating the shift. As workloads become more dynamic and experimentation scales, cost management is no longer a back-office exercise. It’s becoming part of architecture, product planning, and leadership conversations.

FinOps is shaping how technology gets built. Let’s shed some light on the key takeaways from this years State of FinOps Report.

AI spend takes center stage

A remarkable 98% of FinOps practitioners now manage AI-related spend, up dramatically from 31% two years prior, establishing it as the foremost priority for the coming year.

Teams face unique challenges like volatile token consumption and training costs, yet they're harnessing AI for their own gains, such as real-time anomaly detection and automated resource optimization.

This dual role is enabling many organizations to fund AI initiatives directly from cloud savings, fostering a cycle of efficiency and innovation.

AI cost management is also now the #1 skill teams say they need to build. Which makes sense. AI workloads aren’t like traditional infra: they spike, they scale unpredictably, and they can burn cash fast if you’re not paying attention.

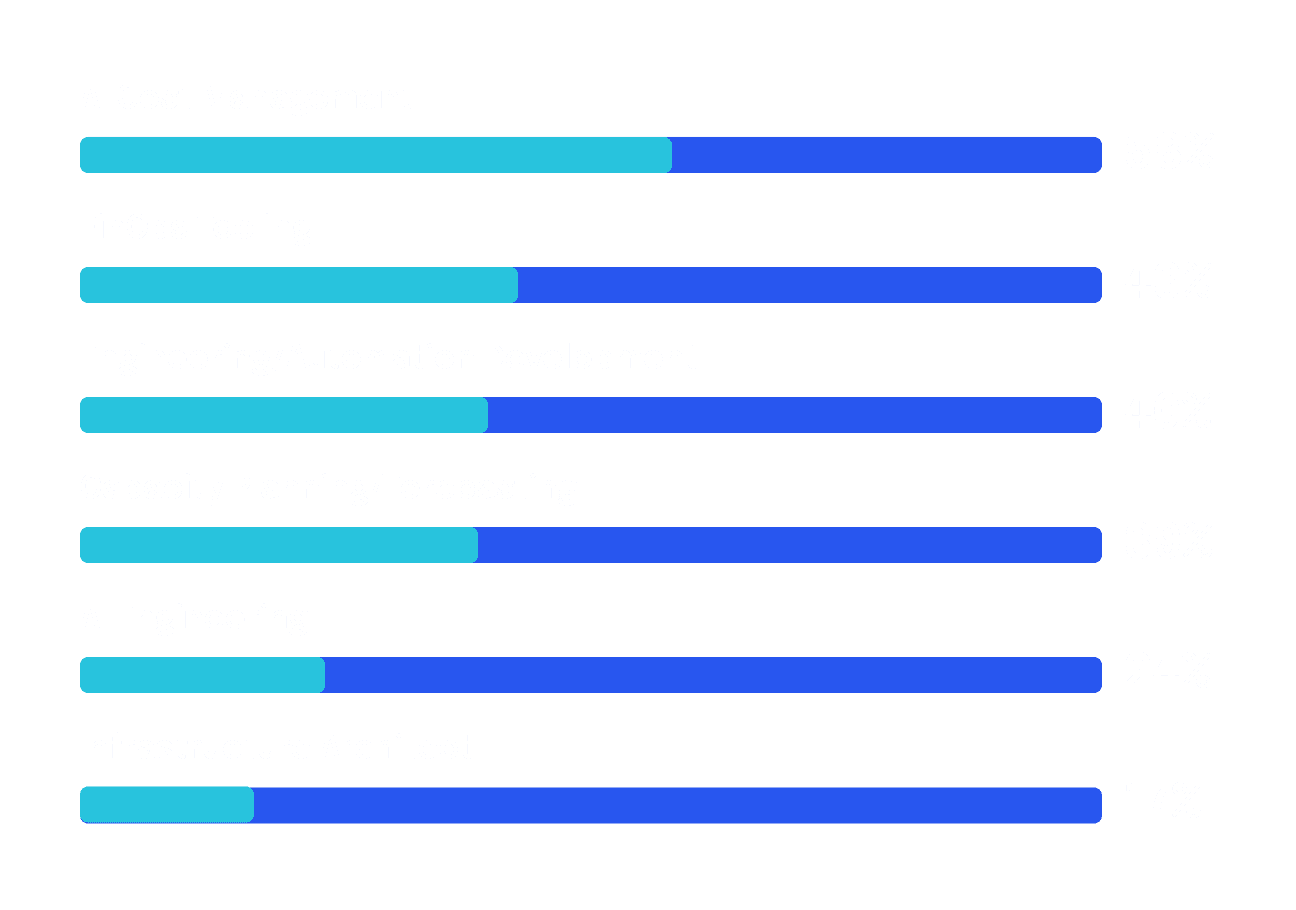

Scope expands beyond just cloud

FinOps boundaries are stretching far beyond traditional cloud services.

90% now manage SaaS spend (a 25% increase year-over-year)

64% manage software licensing (↑ 15%)

57% manage private cloud (↑ 18%)

48% manage data center costs (↑ 12%)

28% are now including labor costs

The growing adoption of FOCUS data specifications is helping standardize information across these diverse areas, especially for AI integrations and SaaS environments.

This expansion reframes FinOps as a comprehensive approach to all technology investments, promoting alignment in complex, multi-vendor setups.

And once you expand scope like that, the conversation naturally moves from “How do we cut waste?” to “How do we make smarter tech bets?”

Optimization still matters, but it’s not the whole game

Teams still care about workload optimization and waste reduction. But the focus is broadening.

Governance.

Forecasting.

Organizational alignment.

Better decision-making before deployment.

These themes are starting to outweigh pure cost-cutting.

What does that actually mean?

Governance is about putting guardrails in place, policies, accountability, clear ownership, so spend doesn’t spiral in the first place.

Forecasting is about predictability. Leadership doesn’t just want optimized bills; they want to know what next quarter or next year looks like, especially with AI workloads in the mix.

Organizational alignment means engineering, finance, product, and leadership aren’t operating in silos. Everyone understands the trade-offs between performance, speed, and cost.

And better pre-deployment decisions? That’s the big one. When architecture choices, vendor selections, and AI experimentation happen with cost visibility upfront, you avoid expensive rewrites and surprises later.

In other words, FinOps is shifting from reactive clean-up to forward-looking decision support.

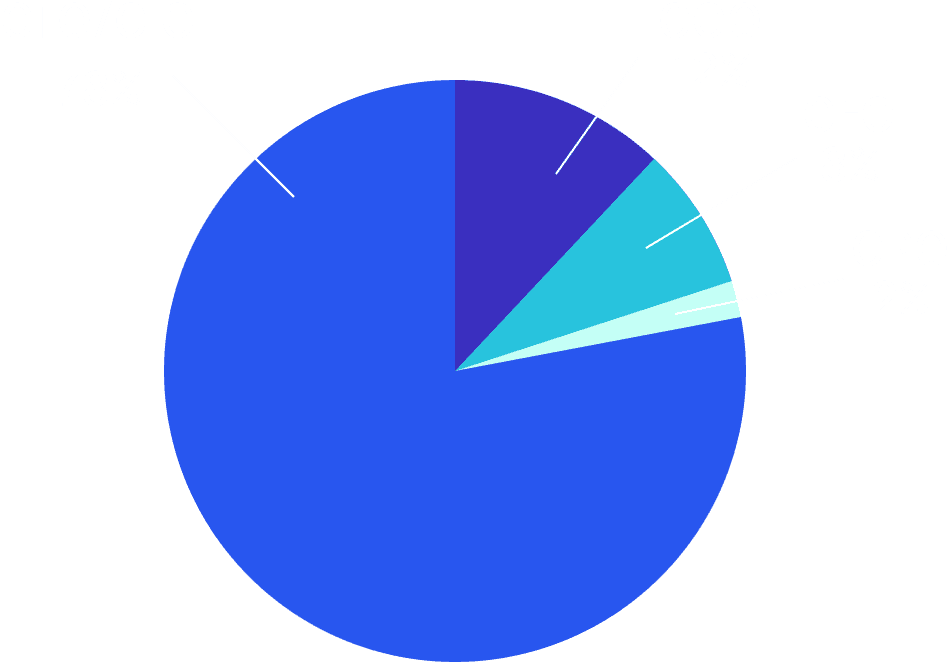

Reporting lines shift upward

Organizational structures are evolving.

78% of FinOps teams now report to CTOs or CIOs, marking an 18% rise.

This amplifies their influence on high-level decisions like cloud provider choices or hybrid infrastructure strategies.

This elevated positioning empowers practitioners to shape technology roadmaps proactively rather than reacting post-deployment. The change reflects broader recognition of FinOps' role in balancing cost, speed, and business outcomes.

When FinOps moves closer to technology leadership, it gains influence over architecture choices, vendor selection, and long-term strategy.

“Shift left” gains momentum

One of the more interesting signals in the report: practitioners want better pre-deployment architecture costing tools.

Teams don’t want to find out what something costs after it’s built. They want cost visibility during design.

That’s a real mindset shift.

When cost awareness shows up early, in architecture reviews, platform discussions, and product planning, you avoid expensive surprises later.

But here’s the tricky part: how do you measure savings from something that never happened?

If a team avoids a scaling mistake, prevents overprovisioning, or chooses a smarter architecture upfront, there’s no dramatic bill to point to. The savings are invisible. That makes ROI harder to quantify.

“Once you fix it, it’s gone… how do we give developers credit for shift-left activities?”

To solve this, the community is exploring a few practical approaches:

Including FinOps contributions in performance reviews alongside feature delivery

Tracking unit costs at the team level and recognizing high performers through chargeback reductions

Setting aside dedicated FinOps budgets for recognition and awards

Because shift-left only sticks if teams get credit for it.

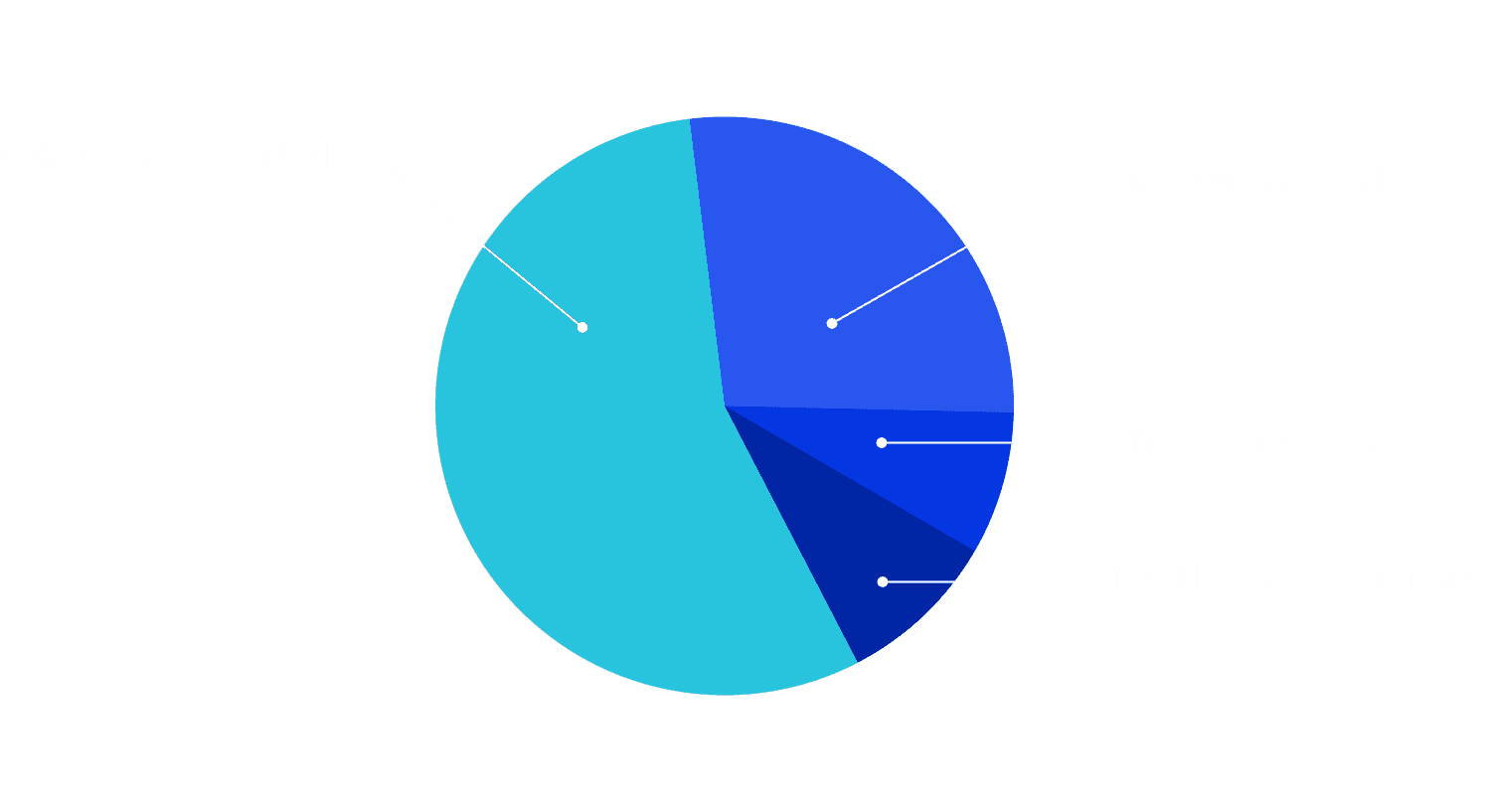

Cross-functional collaboration surges

Partnerships between FinOps, ITFM, and ITAM teams are booming, driven by the need for unified data views in AI-heavy and multi-tech environments.

FinOps teams now work closely with:

ITFM (financial data alignment)

ITAM/SAM (asset & license governance)

ITSM (process & policy)

ESG (sustainability)

Platform Engineering (shift-left execution)

This collaboration is yielding better spend visibility, faster decision cycles, and shared accountability for outcomes. As FinOps matures, these alliances are proving essential for holistic technology governance and sustained value delivery.

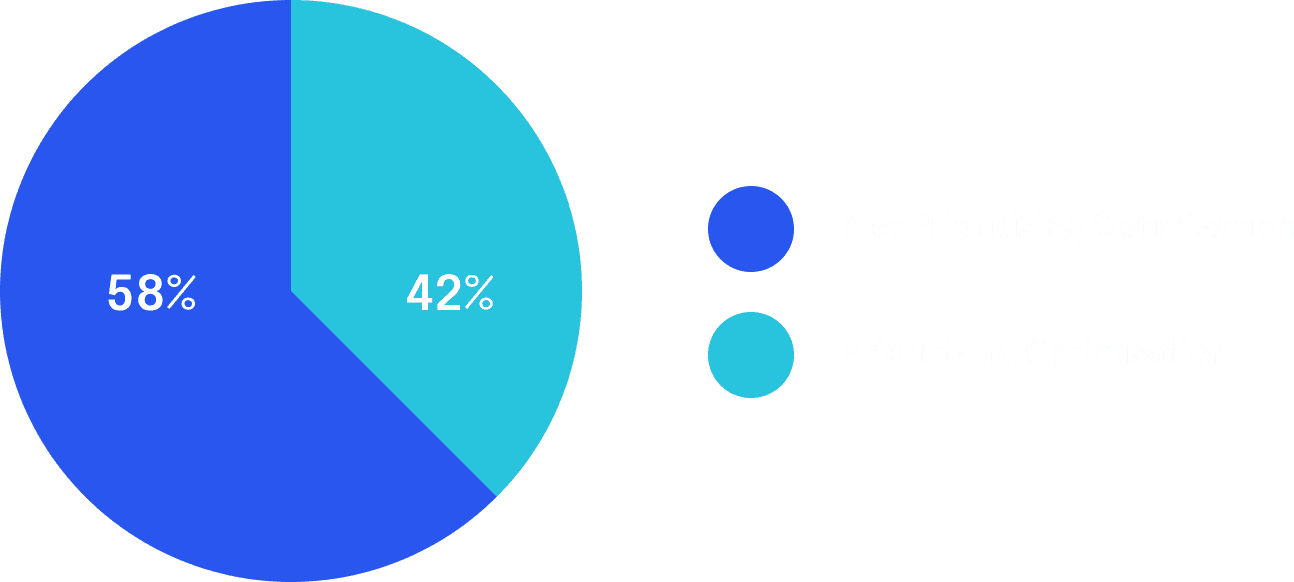

Team models stay lean and scalable

The dominant operating model for most organizations is clear: centralized enablement with federated execution.

About 81% of organizations operate either through centralized enablement (60%) or hub-and-spoke models (21%).

And despite the growing scope, FinOps teams are still lean. Even organizations managing $100M+ in spend typically run with just 8-10 practitioners, supported by a handful of contractors.

So how do they scale? Not by building large central teams.

They scale through federation, embedding cost champions within engineering and product teams, enabling local ownership, and supporting them with automation and AI-driven insights.

The most effective FinOps teams don’t try to control everything centrally. They enable, influence, and distribute accountability.

That’s how they stay small and still drive impact across the entire organization.

So What Does This All Mean?

FinOps in 2026 looks very different from where it started.

It’s broader than cloud.

It’s deeply intertwined with AI.

It’s closer to the CTO.

And it’s showing up earlier in the engineering lifecycle.

Cost is no longer something you review after deployment. It’s something you design for. It’s part of architecture reviews, AI experimentation, vendor decisions, and product strategy. The teams that are getting this right are building smarter systems from day one.

What’s especially clear from this year’s report is that FinOps is becoming a core capability for modern tech organizations. Lean teams. Federated ownership. Cross-functional alignment. Executive visibility. AI at the center.

The companies that treat FinOps as a strategic lever, not a reporting function, will move faster, experiment more confidently, and scale more sustainably. And that’s the real shift.

At Amnic, we see this evolution firsthand, helping teams embed cost intelligence directly into engineering and AI workflows, not bolt it on later. If you’re rethinking how technology spend fits into your product and platform strategy, now’s the time.

[Request a demo and speak to our team]

[Sign up for a no-cost 30-day trial]

[Check out our free resources on FinOps]

[Try Amnic AI Agents today]